Shipping products from China has become a common strategy for small businesses, Amazon sellers, and sourcing managers around the world. China offers low manufacturing costs and a huge variety of products, making it a key sourcing hub for businesses. It’s often called the “factory of the world” due to its massive manufacturing capacity and skilled workforce. However, navigating the shipping process can be complex for newcomers. Success means understanding the available shipping methods, the costs and timelines involved, and the rules (like Incoterms and customs regulations) that govern international trade.

In this guide, we’ll break down everything you need to know about shipping from China. We’ll compare major shipping methods (Air, Sea, Express courier, and Rail) and explain how to choose between them. We’ll look at estimated costs and transit times for each method, so you can plan your logistics budget and schedule. We’ll also demystify Incoterms (like EXW, FOB, CIF, DDP, etc.) with simple examples – these are the international trade terms that define who’s responsible for shipping and import costs at each stage. Next, we’ll walk through a step-by-step overview of the shipping process, from your supplier handing off the goods in China to final delivery at your doorstep. We’ll explain customs clearance and import duties in plain language – no confusing jargon – so you understand how your goods get cleared through customs and what taxes you might owe. Finally, we’ll share practical tips on choosing the right shipping method and freight forwarder, and highlight common mistakes (with solutions) so you can avoid costly pitfalls.

Whether you’re shipping a single box of samples or a full container load of inventory, this guide will help you ship from China with confidence and keep your supply chain running smoothly. Let’s dive in!

Shipping Methods Comparison: Air Freight, Sea Freight, Express, and Rail

When shipping from China, you have several transport options. The best method for you depends on your budget, delivery timeline, and shipment size. Here we compare the main methods – Air Freight, Sea Freight (including FCL/LCL), Express Courier, and Rail Freight – including typical transit times, costs, and use cases for each.

Air Freight (Standard Air Cargo)

Air freight involves shipping goods on cargo aircraft or in the cargo hold of passenger planes. It is much faster than ocean shipping – typically 5–10 days transit airport-to-airport, or about 7–12 days door-to-door including customs. This speed makes air freight ideal for time-sensitive shipments, like replenishing low inventory or delivering perishable or high-value goods quickly. For example, many Amazon sellers use air freight to avoid stockouts when sea freight would take too long.

However, air freight is more expensive than sea freight. Airlines charge by weight (or volumetric weight, if the cargo is bulky but light). On average, standard air freight might cost around $5–$7 per kg for larger shipments, roughly half the price of express courier service but still high compared to ocean rates. Because of the high cost per kilogram, air freight is best suited for lighter, high-value products where speed justifies the cost. A rule of thumb is if your shipment is a few hundred kilograms and needed fast, air freight could be the right choice. Heavier shipments (hundreds of kg or more) become very costly by air, so those often go by sea unless extremely urgent.

- Pros: Very fast transit (about 1–2 weeks door-to-door). More predictable schedules and less risk of damage than sea. Good for urgent or seasonal inventory and high-value goods.

- Cons: High cost per kg. Weight and size limits apply. Requires arranging separate customs clearance and final delivery (unless using a door-to-door service or forwarder).

Sea Freight (Ocean Shipping: FCL & LCL)

Sea freight is the workhorse of global trade – slow but extremely cost-effective for large shipments. Goods are packed in shipping containers and transported by cargo ships. Transit times from China by sea are much longer than air: typically around 3–6 weeks port-to-port, plus additional time for port handling and inland delivery. For example, ocean transit from China to the U.S. West Coast might be ~2–3 weeks on the water, or ~4–6 weeks to East Coast ports. Door-to-door, you should budget about 4–8 weeks total for sea freight deliveries (though delays can occur in peak seasons). This long lead time means sea freight is best for shipments where cost savings matter more than speed – if you can plan well in advance or hold inventory in stock while waiting for replenishment.

The biggest advantage of ocean shipping is low cost per unit. Ocean freight is typically quoted by volume (per cubic meter or per container) rather than weight. For large shipments, the cost can be well under $1 per kg of goods – often only a tenth the cost of air freight on a per-kilo basis. For example, shipping a full container can cost a few thousand dollars total but can carry tens of thousands of kilograms of cargo. Thus, sea is the go-to method for heavy or bulky products and bulk orders. There are two common ways to ship by sea:

FCL (Full Container Load)

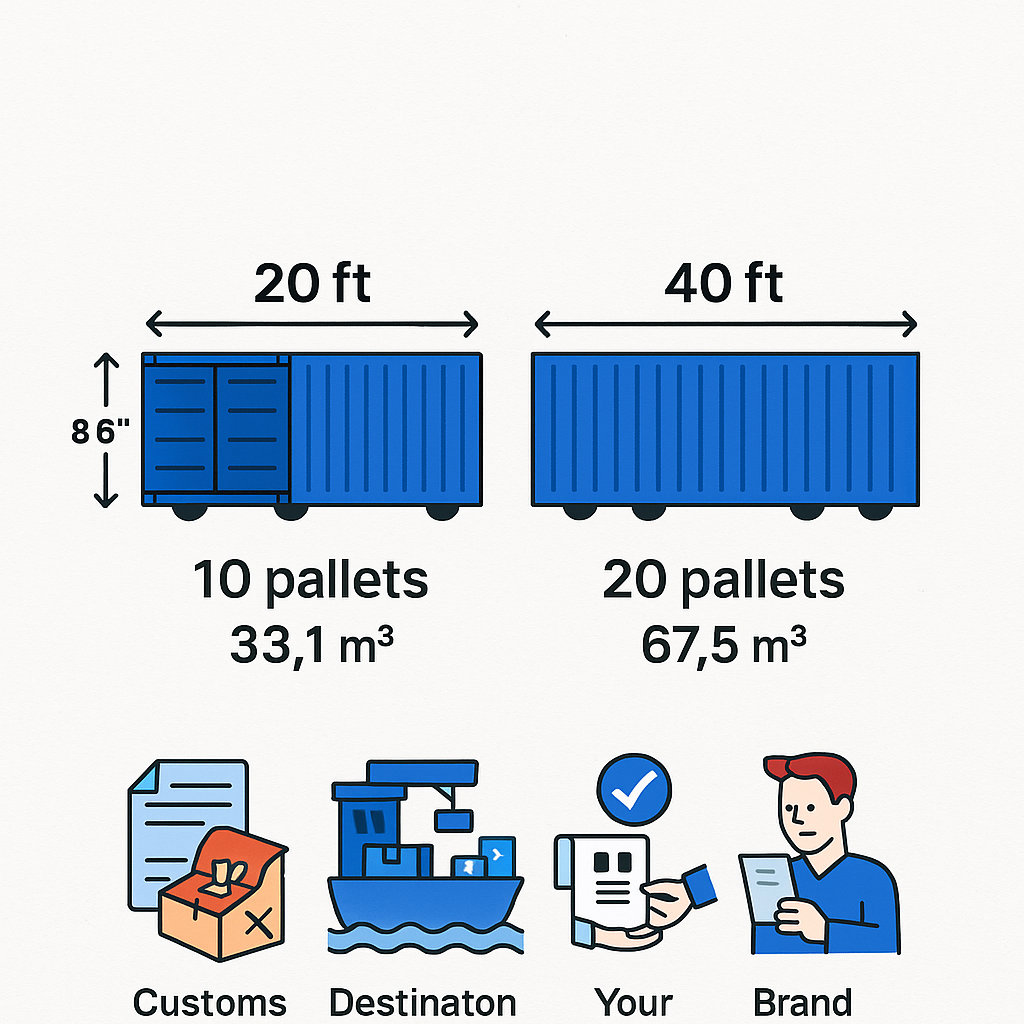

You pay for exclusive use of an entire shipping container. Standard container sizes are 20-foot and 40-foot. A 20ft container holds about 33 cubic meters of volume (roughly 10 standard pallets of goods), while a 40ft container holds about 67 cubic meters (roughly 22 pallets). If your shipment volume is large enough (typically >15 cubic meters), FCL is cost-efficient and minimizes handling (your goods aren’t mixed with others).

LCL (Less than Container Load)

Your cargo shares a container with other shipments. You pay only for the volume you use (e.g. if you have 5 cubic meters of goods, you pay for that space in a consolidated container). LCL is great for smaller shipments that don’t fill a full container. It’s cheaper than FCL for low volumes, but note that LCL can involve extra handling and fees: the cargo must be consolidated in China and de-consolidated at the destination. These extra steps mean LCL shipments often take a bit longer and incur charges at the destination port for unloading and processing. (For instance, an LCL shipment will have charges for receiving, warehouse handling, customs exams, etc., which can add a few hundred dollars that wouldn’t apply if you had a full container). Still, LCL is very useful for small businesses to access ocean freight savings without needing to buy a full container of product.

- Pros: Lowest shipping cost per unit, especially for large volumes. Can ship very large or heavy items that would be impossible or too expensive by air. FCL shipments are sealed and secure from origin to destination.

- Cons: Slow transit (a month or more). Inventory is tied up on the water. There can be additional port fees and complexity, especially with LCL shipments (e.g. terminal handling charges, customs broker fees) that need to be accounted for in your budget. You’ll need to manage customs clearance and arrange trucking from the port to your warehouse (often via a freight forwarder or trucking company). Also, schedules can be affected by port congestion or carrier delays.

Express Courier (DHL, FedEx, UPS)

Express shipping refers to international courier services like DHL, FedEx, UPS, or TNT. With express, the shipping company handles your package door-to-door, including export and import clearance. This is the fastest shipping method – typically **~2–5 days worldwide for documents or small parcels, and about 3–5 days from China to major markets for most packages. Express is extremely convenient: the courier picks up from the supplier and delivers directly to your address. They also take care of customs paperwork on your behalf (you’ll need to provide a commercial invoice and pay duties/taxes, but the carrier will broker the clearance).

For small shipments (usually <150 kg), express can actually be more cost-effective and certainly simpler than arranging air or sea freight, because you avoid many fixed fees at ports. Couriers charge by weight (and apply dimensional weight if a package is bulky). As a rough estimate, express from China might cost around $8–$15 per kilogram (rates vary by carrier, speed, and volume discounts), making it the most expensive per kg mode of shipping. There is often a minimum charge (for example, 0.5 kg or 1 kg minimum). Despite the high cost, express is worth it for urgent deliveries or very small volumes where the absolute cost is still manageable. Many importers use express for sending product samples or rush orders. For Amazon FBA sellers, express can be a way to quickly restock a small quantity while your main inventory is en route by sea.

- Pros: Fastest delivery (as little as 2–5 days door-to-door). Easiest process – the courier handles pickup, shipping, and customs clearance, then delivers to your door. Good tracking and reliability. No need to separately hire a forwarder or trucker for final delivery.

- Cons: Very high cost per weight, not economical for shipments above a certain size. (For larger shipments, air freight or sea + trucking will be cheaper.) Weight and size limitations (very large shipments aren’t practical by courier). You still have to pay import duties/taxes on arrival, which the courier will invoice you (often adding a small clearance fee).

Rail Freight (China–Europe Railway)

For shipments going from China to certain regions (especially Europe), rail freight is an alternative that balances speed and cost. China has established rail links to Europe (often referred to as the “New Silk Road” rail corridor). Containers are shipped by train overland through Asia to Europe, arriving in as little as 12–20 days door-to-door. This transit time is around 40% faster than traditional sea freight on the same routes, though still slower than air. The cost of rail freight is typically about 50% less than air freight for a similar shipment, but higher than ocean shipping. In practice, rail cost is closer to air than to sea – it’s a middle option if you need faster-than-sea service but want to save versus air. For example, a 40-foot container by rail might cost on the order of $6,000–$10,000, whereas by air the equivalent weight could cost twice that, and by sea maybe half of that.

Rail freight is usually offered for containerized cargo (FCL or LCL) moving between inland China and European destinations (common hubs include Germany, Poland, etc.). If you are importing to Europe, rail can cut transit time significantly compared to ocean. It’s also more reliable and eco-friendly than air in many cases, with modern tracking and scheduled services making it a viable option. However, rail routes are subject to capacity and geopolitical considerations, and not all destinations are reachable by rail. Also, you will still need to clear customs (usually at the first point of entry in Europe, like an EU member state) and arrange final delivery from the rail terminal.

- Pros: Faster than sea freight (about 2–3 weeks transit). Cheaper than air freight (roughly half the cost). Good for moderate-sized shipments to Europe where you need a compromise between time and cost. Lower carbon footprint than air.

- Cons: More expensive than ocean freight. Limited geography (mainly Europe/Asia – rail doesn’t help for shipping to Americas or Oceania). Slightly longer transit than pure air. Requires intermodal handling (containers transfer from rail to truck at destination). Not as widely available or frequent as ocean/air services.

Note: If you’re shipping from China to nearby Asian countries or regions connected by land, trucking is another option, but for the scope of this guide we focus on the major methods above. Most small importers will use either express, air, or sea.

Incoterms (EXW, FOB, CIF, DDP, etc.) Explained with Examples

When you negotiate a purchase and shipment from a Chinese supplier, you’ll come across three-letter trade terms like EXW or FOB on quotes and invoices. These are Incoterms – standardized international commerce terms published by the International Chamber of Commerce. Incoterms define the responsibilities of the seller and buyer at each stage of the shipping process, including who pays for which costs, who handles insurance, and where the risk transfers from seller to buyer. In short, Incoterms answer the question: after the factory produces your goods, which party takes care of shipping, export/import paperwork, and delivery – and up to what point? By agreeing on an Incoterm with your supplier, you clarify “who pays for what” in the shipping journey with just a short code, avoiding confusion. Below are some of the most common Incoterms used in shipping from China, explained in simple terms:

EXW (Ex Works)

The buyer takes full responsibility from the seller’s door. The goods are made available at the supplier’s facility (factory or warehouse), and from that moment the buyer must arrange everything: pickup, inland transport in China, export clearance, main shipping, import clearance, and delivery to final destination. Essentially, EXW = “factory pickup”. Example: If you buy 100 units EXW from a Shenzhen factory, you (or your freight forwarder) must send a truck to the factory to get the goods and handle all shipping after that. Buyer bears all costs and risk once the goods leave the factory. (Tip: If using EXW, ensure your supplier at least helps load the goods onto the truck – most will, but it’s wise to confirm this in the contract.)

FOB (Free On Board)

The seller is responsible for getting the goods onto the ship (or plane) at the port of origin, after clearing Chinese export customs. Once the goods are loaded on the vessel at the port in China, the buyer assumes responsibility for the shipment from that point forward. In practical terms, FOB means the supplier handles transport from their factory to the port, takes care of export permits and customs clearance, and loads the shipment on the outgoing ship/aircraft. The cost of ocean/air freight from China to your destination, plus everything after arrival, is paid by the buyer. Example: You purchase goods FOB Shanghai – your supplier will transport them to Shanghai Port and load the container. You then pay the ocean freight, and when the ship arrives at your country’s port, you handle unloading, import clearance, and delivery to your warehouse. FOB is popular because the handover point (on board at port) is convenient; the seller handles all local China side formalities, and the buyer controls the main shipping and beyond. It’s important to know which port is the FOB point (FOB Shenzhen, FOB Ningbo, etc.) so you can arrange pickup there.

CIF (Cost, Insurance & Freight)

The seller arranges and pays for ocean freight to your destination port, including insurance for the cargo in transit. Under CIF, the seller’s responsibility extends further than FOB – they cover the cost to get the goods to the port of arrival (e.g. CIF Los Angeles means the supplier pays for shipping to LA and buys cargo insurance for the journey). However, risk still transfers at loading on the vessel in China (technically, under CIF the seller pays insurance for the buyer’s benefit since the buyer bears risk once on board, but this is a technicality). The buyer is responsible for import customs clearance, duties, and onward delivery from the arrival port. Example: You have a quote CIF Hamburg – the supplier will ship the goods by sea to Hamburg port and provide insurance; you will then handle German customs and trucking to your location. CIF is convenient for buyers who want the supplier to manage the freight booking, but be aware the supplier might choose a cheaper or slower shipping service. Also, the buyer still pays import duties and port fees at the destination.

DDP (Delivered Duty Paid)

This is the most buyer-friendly (and seller-responsible) term. The seller handles everything from their door in China to the buyer’s door, including all shipping, insurance, export and import formalities, and even import duties. In a DDP deal, you essentially receive the goods at your doorstep and just “sign for it”. The seller takes on all risks and costs until final delivery. Example: You order a batch of goods DDP to your address – the supplier (or their forwarder) will pick up the goods, ship them, clear customs in your country and pay any duties/taxes, then deliver to you. All fees are included in the price you paid. This sounds great, and it’s very convenient for the buyer. However, DDP can be more expensive because the seller will charge a premium to cover all those extra costs and risk. Also, you rely on the seller’s choice of shipping service and customs broker, which might not be the cheapest or fastest. DDP is often used for courier shipments or by sourcing agents offering “door-to-door” service. If you get a DDP quote, it’s wise to also compare an FOB + your own freight quote to see the cost difference.

Others: FCA, DAP, etc.

There are other Incoterms as well. For instance, FCA (Free Carrier) is similar to FOB except it can be for any transport mode – the seller delivers the goods to a carrier or terminal that the buyer designates. DAP (Delivered At Place) means the seller delivers to a named destination (like the buyer’s city or warehouse) but without unloading; the buyer handles import duties and customs clearance. DAP is like “almost DDP” – seller gets it to your door, but you pay the import tax. CFR (Cost and Freight) is like CIF but without insurance. FAS (Free Alongside Ship) means the seller brings goods to the port and places them next to the vessel, but doesn’t load – which is rarely used nowadays. The 11 Incoterms each have specific meanings, but the ones described above (EXW, FOB, CIF, DAP, DDP) are the most commonly seen in China trade.)

In practice, many importers start with FOB terms for goods from China. FOB is popular because it splits the responsibilities neatly: the supplier takes care of origin-side logistics (getting goods out of China), and you as the buyer take charge of the main transport and destination-side process. If you are new and want simplicity (and don’t mind paying extra), DDP might be attractive since the seller will handle everything – just be cautious and ensure the seller is trustworthy, because you’ll be relying on them to pay duties and deliver properly. On the other end, EXW gives you full control (you pick up from the factory) but requires you to have a freight forwarder or plan in place in China; it’s usually only recommended if you have experience or a logistics partner, since arranging pickup and export from a foreign country can be challenging on your own.

Example scenario

Let’s say you got a great price on some goods “FOB Shanghai” and you assume everything’s covered to your door – that could be a misunderstanding. Under FOB, once the goods are on the ship in Shanghai, you (the buyer) become responsible for the costs after that point. When the shipment arrives, you’d have to pay for unloading, terminal handling, customs clearance, trucking from port, etc. Many first-timers are caught off guard by these destination charges. In one real case, an importer agreed to FOB terms and later faced over $250 in unexpected port and handling fees that she hadn’t budgeted. If she had purchased under DDP terms instead, the seller would have been responsible for all those costs up to final delivery. The lesson: make sure you understand the Incoterm on your contract so you know which parts of the journey (and which costs) you must cover. If you’re unsure, ask questions or consult a freight forwarder – never assume “shipping included” unless it explicitly says DDP or a similar term that covers door delivery.

Step-by-Step Shipping Process (From Supplier Handoff to Final Delivery)

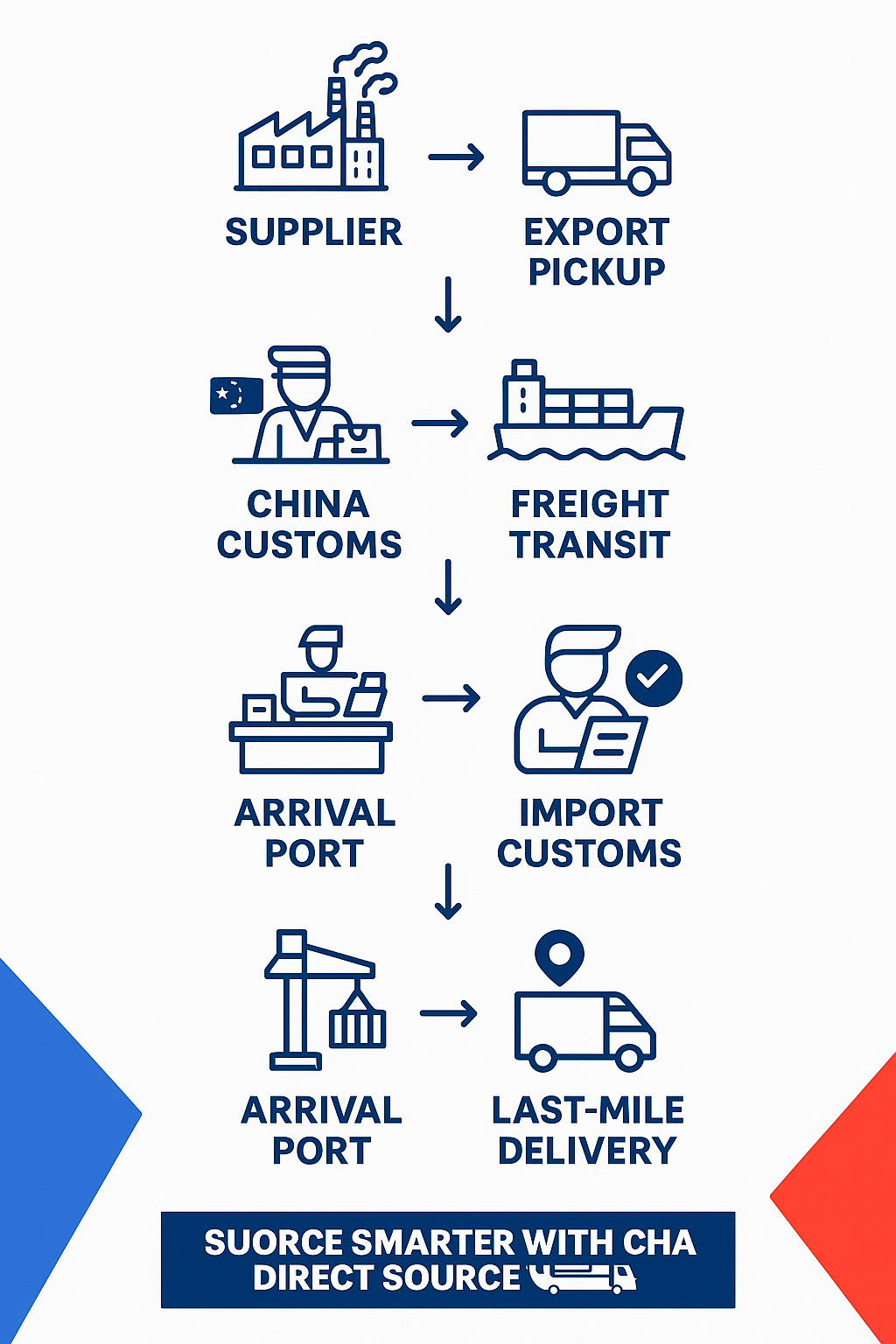

Shipping from China involves multiple stages and handoffs. Here’s a step-by-step breakdown of the typical shipping process for an international shipment, from the moment your supplier finishes production to the moment you receive the goods. Understanding each step will help you track your shipment and know what needs to be done at each point:

Step 1: Goods Ready at Supplier & Packaging

The process begins with your supplier. They finish manufacturing your order, conduct any quality inspections, and package the goods for export. Typically, goods are packed into cartons, and then onto pallets or into crates if needed. At this stage, you or the supplier will prepare the commercial invoice, packing list, and any other required documents. The shipment’s details (weight, dimensions, contents) are finalized so booking transport can proceed.

Step 2: Pickup & Inland Transport in China

Next, the goods need to be transported from the supplier’s facility to the international departure point (airport, seaport, or rail terminal). If your terms are EXW, you (or your freight forwarder) will arrange a truck pickup at the factory. If terms are FOB or similar, the supplier arranges local transportation – for example, trucking the goods to Shanghai Port or to the air cargo terminal at Guangzhou airport. In the case of LCL sea shipments, the goods might first go to a consolidation warehouse near the port to be combined into a container with other cargo. Timing: This step can take a day to several days depending on distance (e.g., factory in inland China trucking to a coastal port).

Step 3: Export Customs Clearance (China)

Before goods can leave China, they must clear export customs. The exporter (usually the supplier or their forwarder) files export documentation with Chinese Customs, declaring what the goods are and their value. China generally doesn’t levy export taxes on most goods, but they still require an export declaration. If your terms are FOB or CIF, the supplier typically handles this export clearance at their cost. If you are using EXW, your freight forwarder will handle export clearance on your behalf (which may require a Chinese customs broker and the supplier’s cooperation to provide paperwork). Export clearance needs a commercial invoice, packing list, and possibly export licenses if the goods are regulated. Once cleared, customs issues permission to load the goods for departure.

Step 4: Origin Handling & Loading

The cargo is now at the origin port or airport. Here, it goes through origin handling: for sea freight, the container (FCL) is loaded on the ship, or for LCL, your goods are loaded into a shared container. For air freight, the pallets or cartons are loaded onto the plane. This step involves the port or airport authorities. In sea freight, you might encounter a “cut-off” date by which the container must be delivered to port for loading. Once loaded, if it’s FOB terms, the risk and cost transfer to you (the buyer) at this point – your goods are now on board, ready to depart. The carrier will issue a bill of lading or air waybill, which is the official shipping document.

Step 5: International Transit (Ocean or Air or Rail journey)

The shipment departs China and is in transit to the destination country. This is the long haul across the ocean, through the air, or over land by rail. Transit time depends on method: ~3–5 days by express air, ~1–2 weeks by standard air freight (including some waiting and transfer time), ~4–6 weeks by ocean, or ~2–3 weeks by rail as discussed in the methods section. During transit, you can usually track the progress (air shipments update when flights depart/arrive; ocean shipments can be tracked by container or vessel status).

Step 6: Arrival at Destination Port/Airport

When the shipment arrives in your country (or at the specified destination port), it must be unloaded from the plane or ship. For sea freight, the container is offloaded from the ship at the port’s terminal. If it’s FCL, the whole container is put in the port’s yard awaiting further instructions. If LCL, the container will go to a CFS (Container Freight Station) where it will later be opened and your cartons separated out. For air freight, the cargo is moved to a cargo warehouse at the airport. At this point, the carrier or its agent will typically issue an Arrival Notice to notify the importer (you) or your forwarder that the goods have arrived and can be processed for customs.

Step 7: Import Customs Clearance

Now the shipment must clear import customs in the destination country. This step can be handled by yourself (if you’re experienced and the shipment is small) or by a customs broker or the freight forwarder’s agent. The customs authorities will require documentation: typically the commercial invoice, packing list, bill of lading/air waybill, and potentially a certificate of origin or other certificates (for example, for food or medical products, additional permits may be needed). Customs will review the documents, check if any import licenses are required, and determine the import duties and taxes applicable. They may inspect the goods physically or via X-ray. Assuming everything is in order, customs calculates the import duty and/or VAT (for countries that charge VAT/GST on imports). Import duties must be paid before the goods are released. (More on duties in the next section.) If you shipped by express courier, the courier (e.g. DHL) will typically handle this clearance and advance the duty payment for you, then bill you. If you shipped by sea or air freight, your customs broker or forwarder will coordinate with you to get the duties paid and clearance done. Upon clearance, customs will issue a release.

Step 8: Destination Handling

After customs clears the cargo, there may be some destination port handling. For FCL sea freight, the full container can now be picked up from the port. Often a trucking company (drayage) will take the container out of the port, either to deliver it directly to you or to a warehouse where it’s unloaded. For LCL shipments, the container is taken to the CFS warehouse and de-consolidated – your goods are unpacked from the container along with other importers’ goods. The CFS will make your shipment available for pickup once you or your agent has paid any handling fees. For air freight, once cleared, the cargo is released from the airport warehouse to your appointed trucker or agent who will pick it up. At this stage, any destination fees need to be settled: for example, terminal handling charges, warehouse fees, or forklift fees, and customs brokerage fees if any. It’s normal to incur a variety of small charges at the port/airport on top of the main freight cost.

Step 9: Inland Transport to Final Destination

Finally, the goods need to reach your doorstep (or Amazon FBA warehouse, or wherever the final destination is). If it’s an FCL sea shipment, a truck (with a chassis trailer) might deliver the full container to your facility, where you unload it (usually you get a few hours free time to unload, then the trucker takes the empty container away). For LCL or air shipments, a local trucking or delivery service will take the pallets/cartons from the warehouse and deliver to your address. This leg can be arranged by you, or often your freight forwarder will handle the door delivery as part of their service (if you’ve contracted them for door-to-door). For smaller parcels, this final leg might even be via a parcel carrier. Once the goods arrive at your warehouse/office/fulfillment center, you sign for the delivery – success! 🚚📦

Step 10: Receipt and Inspection

It’s a good practice to inspect the goods upon arrival. Check that the shipment is complete and undamaged. If there are issues (missing boxes, damage, etc.), document them immediately and notify the carrier or insurer. Assuming all is good, you can then proceed to distribute or sell your products.

Throughout this process, a freight forwarder can coordinate many of these steps on your behalf. A good forwarder will handle the bookings, paperwork, and communications between the different parties (truckers, carriers, customs brokers), acting as your logistics partner. This can greatly simplify the shipping process for you (more on choosing a forwarder in the Tips section).

Customs Clearance and Import Duties (Explained Simply)

Getting your goods through customs is a critical part of the shipping journey. Customs clearance is the process where government authorities check your imported goods, make sure they comply with regulations, and assess any import taxes (duties). Here’s what you need to know in simple terms:

Import Duties (Tariffs)

Many countries charge an import duty (tariff) on goods from abroad. This is essentially a tax on your goods, calculated as a percentage of the product value. The rate depends on your product’s category and the country of origin. Every product is classified by an international code (HS Code) which determines its duty rate. For example, leather shoes might have a 10% import duty, while electronics might have 0% or 5%, and some specialty items could be higher. In recent years, some goods from China have extra tariffs (for instance, the U.S. imposed tariffs up to 25% on many Chinese goods). In general, duty rates can range widely – often around 0–20%, but could be as high as 25% or more for certain categories. It’s important to research your product’s duty rate before importing, so you can budget this cost. You can often find duty rates on your government’s customs website or by consulting a customs broker. (The first 6 digits of the HS code are global; duty lookups use the full code, e.g., a 10-digit HTS code in the US)

De Minimis and Taxes

Many countries have a de minimis value, under which imports are exempt from duties (and often sales tax) to simplify small personal shipments. For example, the US historically allowed shipments valued under $800 to enter duty-free. However, policies can change – as of 2025, the US has suspended that $800 de minimis exemption for goods from China, meaning all imports from China are now subject to duties regardless of value. The EU has a low de minimis (and now even small packages require VAT payment). So, don’t assume small shipments will automatically be tax-free; check your country’s current rules. In addition to duties, imports may be subject to VAT/GST or other taxes upon entry (common in Europe, where VAT is applied to imports). Couriers often collect these taxes on delivery if not prepaid.

Customs Clearance Procedure

To clear customs, you (or your agent) must file an entry declaration with the customs authority when the goods arrive. Typically, you’ll submit the commercial invoice (which shows the value and details of the goods), a packing list, and the bill of lading/air waybill. If any goods need special permits (e.g. FDA approval for food/drugs in the US, CE certification in Europe, etc.), those documents must be provided. The customs officer will verify the paperwork, possibly inspect the goods (either randomly or if something looks questionable), and then calculate the duty and tax. You must then pay the calculated duties/taxes before customs will release the shipment. Payment is usually done via the customs broker or courier (they front the payment and bill you, or you pay online for postal shipments). Once paid and approved, the goods are cleared – you’ll get a release order or see the status updated to cleared, and the shipment can proceed to delivery.

Customs Brokers

For commercial shipments (especially above a certain value, e.g. over $2,500 in the US requires a formal entry), it’s often wise to use a customs broker. Brokers are licensed professionals who know import regulations and handle the clearance paperwork for you. They ensure the HS codes are correct, help resolve any issues, and advise on any required certificates. Using a broker can prevent mistakes (like misclassification or missing forms) that might lead to delays or fines. Many freight forwarders have affiliated customs brokers, or carriers like DHL/UPS have in-house brokers for express shipments. For smaller shipments, you might skip a broker (couriers handle it, or you do a simple online declaration), but for larger shipments a broker’s fee is usually well worth the peace of mind.

Import Compliance

To avoid problems at customs, make sure the documentation is accurate. The invoice should correctly describe the goods and match what’s actually shipped. The values should be truthful – undervaluing to save on duties is illegal and risky (customs can penalize you heavily if caught). If your products are subject to specific import regulations (e.g. safety standards, quotas, trademarks), ensure you have those in order before shipping. Common issues that can hold up a shipment include missing documents, incorrect HS codes, or restricted goods. If customs flags your shipment for inspection, it could delay things by days or even weeks, so it pays to do things by the book. Working with experienced partners (supplier, forwarder, broker) helps a lot here.

In summary: Customs clearance is like your goods “checking in” at the border. With the right preparation – knowing your HS codes and duty rates, having proper paperwork, and maybe getting professional help – your shipment should clear without trouble. And remember to factor in import duties/taxes as part of your product cost. For example, if you import a gadget valued $10,000 and its duty rate is 10%, you’ll owe $1,000 in duty on arrival. That’s part of your “landed cost” and will affect your profit margins. The good news is once you’ve done it a couple of times, the customs process becomes routine. Just don’t hesitate to ask a customs broker or logistics expert if you’re unsure about any requirements – it’s better to double-check than to have goods stuck in customs.

Quick tip: Many countries have online tools to estimate duties. In the US, you can use the Harmonized Tariff Schedule (HTS) listings or tools from USITC, and in Europe use the TARIC database. Knowing the duty % beforehand can prevent surprises.

Tips on Choosing the Right Shipping Method and Freight Forwarder

Selecting the optimal way to ship your goods – and the right partner to help – can make a huge difference in cost, speed, and headaches. Here are some practical tips to guide your decision:

Match the Shipping Method to Your Needs

Consider the size, weight, and urgency of your shipment when choosing between air, sea, express, or rail. As a general rule, use air freight or express for urgent, smaller shipments, and sea freight for large, heavy shipments or when transit time is less critical. If your shipment is very small (say a few boxes under 100 kg) and you need it fast, express courier is often simplest. If it’s a pallet or two (a few hundred kg) and you can allow a week or two, standard air freight might save money over express. If it’s several pallets or more (1000+ kg or many cubic meters) and you can wait 4-6 weeks, shipping by ocean will drastically reduce cost. Sometimes a combination approach works: ship a small urgent portion by air to meet immediate demand, and send the rest by sea to save money. Tailor the method to the nature of your product and business timelines.

Get Multiple Quotes and Compare “Total” Costs

Don’t just look at the headline freight cost – consider all the related fees. For example, an ocean freight quote might seem cheaper than air, but remember to add port fees, customs broker fees, and local delivery charges on both ends. Sometimes newbie importers assume sea freight is always cheapest and then get surprised by hefty destination fees for LCL shipments. Always compare the full landed cost and transit time for each option. A good freight forwarder can provide a door-to-door quote that itemizes all charges. It can also be enlightening to get a DDP quote from your supplier versus arranging shipping yourself (FOB + hiring a forwarder) – compare which comes out better. The cheapest quote isn’t always the best if it leaves out necessary services that you’ll pay for later. Aim for cost-effectiveness, not just cheapest upfront.

Choose a Reliable Freight Forwarder/Logistics Partner

A freight forwarder is essentially your travel agent for cargo – they can handle shipping arrangements, consolidation, documentation, and coordination among carriers. Especially if you’re new to importing, a good forwarder is invaluable. Look for a forwarder with experience in shipping from China to your country, preferably with the type of goods you have. They should offer the services you need (e.g. do you need them to handle customs clearance and last-mile delivery?). Check reviews or get recommendations from other importers if possible. A reliable forwarder will communicate clearly, provide transparent pricing, and help you navigate any issues. They can also advise you on the best shipping method for your situation. Working with a forwarder removes the burden of arranging each piece of the logistics puzzle yourself – for instance, if you agreed EXW terms, the forwarder will seamlessly arrange pickup in China, which could be very challenging on your own. Don’t hesitate to reach out to a few forwarders and compare their responsiveness and quotes.

Verify What’s Included (and Not) in Quotes

Shipping quotes can be complicated. Make sure you understand what each quote covers. For example, an air freight quote might be airport-to-airport only – meaning it doesn’t include trucking to your door or customs fees. A sea freight quote might be port-to-port, with no mention of the hundreds of dollars in destination port charges you’ll incur. Ask the forwarder, “Is this door-to-door? Does it include customs clearance and duties? What about insurance?” Incoterms come into play here as well – clarify up front so you won’t be blindsided later. If using a courier like DHL, ask if the price includes door delivery and how duties will be handled. Being clear on the scope of service will help you compare apples to apples.

Consider Transit Time and Inventory Planning

Think about how the shipping transit time fits into your inventory management. If you always ship by sea because it’s cheapest, ensure you order well in advance and keep enough stock on hand to cover the long lead time. If you’re in a pinch time-wise, be willing to spend more on air to avoid stockouts (running out of product can be more costly than paying for faster shipping!). One strategy is to use sea freight for regular replenishment and occasionally use air freight for buffer stock or new product launches that are time-sensitive. Also remember to account for potential delays – for example, shipments around Chinese New Year or holiday peak season can take longer. Build some buffer into your lead times. A good forwarder can help you estimate realistic door-to-door transit times so you don’t cut it too close.

Check for Additional Services

Depending on your needs, you might benefit from additional logistics services. Some freight forwarders also offer cargo insurance (highly recommended for valuable shipments – the cost is relatively low, usually a fraction of a percent of the goods’ value, to protect against loss or damage in transit). If you need help on the China side, some forwarders can do cargo inspections or warehousing (e.g. consolidating goods from multiple suppliers into one shipment). On the destination side, if you don’t have a warehouse, some forwarders or 3PLs can receive and store your goods. If shipping to Amazon FBA, look for forwarders who specialize in FBA deliveries – they will know Amazon’s requirements for delivery appointments, labeling, etc. Also confirm what tracking and customer service support the forwarder provides (you want to be kept updated on your shipment’s progress). The more complex your supply chain, the more you’ll value a forwarder who can provide end-to-end solutions.

Build Relationships

Once you find a good freight forwarder or carrier, stick with them and build a relationship. Consistent volume and loyalty can sometimes lead to better rates or priority service over time. Similarly, maintain good communication with your supplier about shipping – they can often assist or at least ensure your goods are ready on time for pickup. A cooperative supplier who understands your logistics plan (e.g. when the freight forwarder will collect, proper export packing, documents ready) will make the process smoother. Basically, treat your logistics partners as part of your team.

In summary, choosing the right shipping method comes down to balancing cost vs. time. Always evaluate your options instead of assuming one method is best – sometimes a slightly more expensive method actually saves money when you factor all costs (or saves your business from stockouts). And choosing the right freight forwarder means finding an experienced, trustworthy partner who can handle the complexity of international shipping so you can focus on your business. Don’t be afraid to ask questions – a good forwarder will happily explain the process and charges. With the right approach and partners, even a small business can manage international shipping like a pro!

Common Mistakes in Shipping from China (and How to Avoid Them)

Finally, let’s cover some common mistakes people make when importing from China – and tips on how you can avoid these pitfalls. Learning from others’ mistakes will save you time, money, and headaches:

Mistake #1: Automatically choosing sea freight for everything (or dismissing air freight as “too expensive”)

Many new importers assume ocean shipping is always the cheapest and therefore always the best option. While ocean is cheapest per unit, small shipments by sea can incur lots of extra fees (consolidation, port handling, minimum charges) that add up. Sometimes, if your shipment is small, air freight or express can actually be cost-effective once you include all the “hidden” costs of sea freight.

How to avoid: Evaluate each shipment individually. Calculate the total landed cost for both sea and air. Don’t ignore air freight – for lightweight, high-volume items (e.g. a bulk order of pillows), air might even make sense because ocean would charge mostly by volume. If you do use LCL ocean, be prepared for destination charges. The key is to do the math; you might be surprised that air isn’t as expensive as you thought, especially for smaller loads or when time saved has value.

Mistake #2: Not understanding the Incoterms you agreed to

We discussed Incoterms in detail above, and this is exactly why – if you don’t fully grasp who is responsible for what, you can face unexpected costs or confusion. For instance, you might agree to buy FOB and later realize that doesn’t include inland delivery to your warehouse, or you choose CIF and then are surprised by the import duty bill.

How to avoid: Always clarify the shipping terms (Incoterms) on your purchase. If you’re not sure what a term covers, ask or look it up. Remember that EXW means you handle everything from the factory, FOB means you pay from port of departure onward, CIF means you pay from port of arrival onward, and DDP means the supplier covers delivery to your door (you just unload). Double-check with your supplier about any costs you might be responsible for. It can help to get a quote for a more inclusive term (like DDP) and a less inclusive one (like FOB) to compare the “all-in” pricec. By understanding Incoterms, you won’t be caught off guard by, say, a $250 port bill you didn’t anticipate on a FOB shipment.

Mistake #3: Forgetting about import duties and regulations (or misclassifying your product)

Some importers focus only on the product and shipping cost, and forget that customs duties or import taxes can be significant. Additionally, using the wrong product classification (HS code) can result in paying the wrong duty rate or even fines.

How to avoid: Do your homework on import duties for your product before you order. Request the HS code from your supplier or identify it yourself, then check what the duty rate is in your country. If your product is subject to special tariffs (like U.S. Section 301 China tariffs), factor that in (e.g. 7.5% or 25% extra on certain goods). Ensure you comply with any import regulations (for example, certain electronics might need FCC certification, or toys might need safety testing documents). Working with a customs broker can help avoid misclassification. Bottom line: know your product and its import requirements – it’s part of the cost of doing business and avoiding nasty surprises at customs.

Mistake #4: Trying to handle everything without a freight forwarder

International shipping has a lot of moving parts (literally!) – dealing with carriers, customs, and foreign logistics can be overwhelming if you’re not experienced. Some new importers attempt to DIY their first shipment entirely and run into issues like not knowing how to get their goods from an inland factory to the port, or how to fill out customs forms.

How to avoid: Strongly consider using a freight forwarder, at least for your initial shipments. A forwarder’s expertise is invaluable – they speak the language of logistics and can, for example, easily arrange a local truck in China to pick up your EXW goods (something that might be very difficult for you to coordinate from abroad). They also help with documentation to prevent errors. Yes, forwarders charge a fee, but they often save you money overall by avoiding mistakes and getting better freight rates. Think of a forwarder as a guide through unfamiliar territory. Once you gain experience, you’ll know which parts you might handle yourself, but even then, a good forwarder is usually worth it for the convenience.

Mistake #5: Underestimating transit time and not building in a buffer

Lead times from China can be longer than expected, and quoted transit times can be misleading if you don’t consider the entire door-to-door journey. A classic mistake is hearing that “ocean transit is ~2 weeks” and assuming you’ll have the goods 14 days after they leave – not accounting for pre-carriage and post-carriage time.

How to avoid: Always plan for the full shipping timeline, not just port-to-port. For example, if a ship takes 14 days port to port, remember to add the time for: pickup and consolidation before the ship (could be 5-7 days), and unloading, customs, plus trucking after the ship (another 5-7 days). In reality, that 14-day sea transit could mean 4 weeks door-to-door. Similarly, air freight might be 2 days in the air but you’ll have a few days of handling on each end. Work with your forwarder to get a realistic delivery date. And always build a buffer for unexpected delays (port congestion, customs inspections, etc.). It’s wise to have some safety stock or time cushion so your business isn’t crippled if a shipment is late by a week or two. Essentially, hope for the best transit but plan for the worst (within reason). This way you won’t be in panic mode if things take a bit longer.

Mistake #6: Neglecting paperwork and compliance, leading to customs delays

Some importers fill out paperwork at the last minute or omit necessary information, only to have their shipment stuck in customs because something wasn’t done right. Or they don’t realize their product needed special documentation (like a certificate, or compliance with a quota) until customs flags it.

How to avoid: Prepare your documents carefully. Triple-check that your commercial invoice has the correct values, detailed description of goods, the correct Incoterm, and matches the actual shipment. Ensure the recipient/importer name on documents is correct (especially if you as an individual are importing versus a company – mistakes here can cause clearance issues). If you’re unsure about documentation, hire a customs broker who will make sure everything is in order. Also, stay informed about compliance for your product – for example, certain food items might need FDA prior notice (for US) or CE marking for electronics in Europe. By taking documentation seriously and providing any needed info to your forwarder or broker in advance, you minimize the risk of your container being held due to missing or incorrect paperwork. And if your shipment is randomly selected for inspection, having all papers in order will help it go smoothly. In short: be proactive with paperwork, and lean on professionals for guidance.

By being aware of these common mistakes and following the suggested precautions, you can significantly smooth out your shipping experience. Each lesson was likely learned the hard way by someone else – now you can learn it the easy way! Remember, international shipping has a learning curve, but with research and the right partners, even a small business can handle it effectively. Here’s to hassle-free and cost-efficient shipping from China for your business. Happy shipping! 🚢✈️📦