Importing industrial supplies and components from China to the U.S. has become a mainstream strategy for manufacturing managers and procurement teams looking to optimize cost and innovation. China’s expansive manufacturing sector produces a vast array of industrial parts – from precision CNC components to heavy castings – making it a critical node in the global industrial supply chain. In fact, China has grown into the largest supplier in all industrial product categories worldwide, illustrating how importers across sectors rely on Chinese manufacturers. This article offers a clear, professional (yet conversational) guide to help you navigate sourcing industrial parts from China, covering popular product categories, key sourcing risks, compliance standards, supplier vetting, and quality control best practices. Whether you’re importing manufacturing components for an OEM or managing an industrial supply chain China–to–US, these insights and best practices will set you up for success.

Popular Industrial Product Categories Sourced from China

China’s factories produce a broad range of industrial product categories at competitive prices and huge scale. Below are some of the most popular categories that U.S. companies source from China:

- Valves and Fittings: Industrial valves (gate, ball, butterfly, etc.) and pipe fittings for oil & gas, water, and manufacturing applications are widely made in China, often to international specs. Chinese valve manufacturers have emerged as global players, supplying high-pressure and specialty valves to major projects.

- Fasteners: From basic screws and bolts to high-tensile specialty fasteners, China’s fastener industry is a massive export sector. Regions like Zhejiang province are known for fasteners and standard parts, supplying automotive, construction, and machinery OEMs worldwide.

- Electric Motors and Power Tools: Many electric motors, from small DC motors to AC induction motors, are produced in China. Additionally, a large share of branded power tools (drills, grinders, saws) are either made in Chinese factories or rely on Chinese-made components.

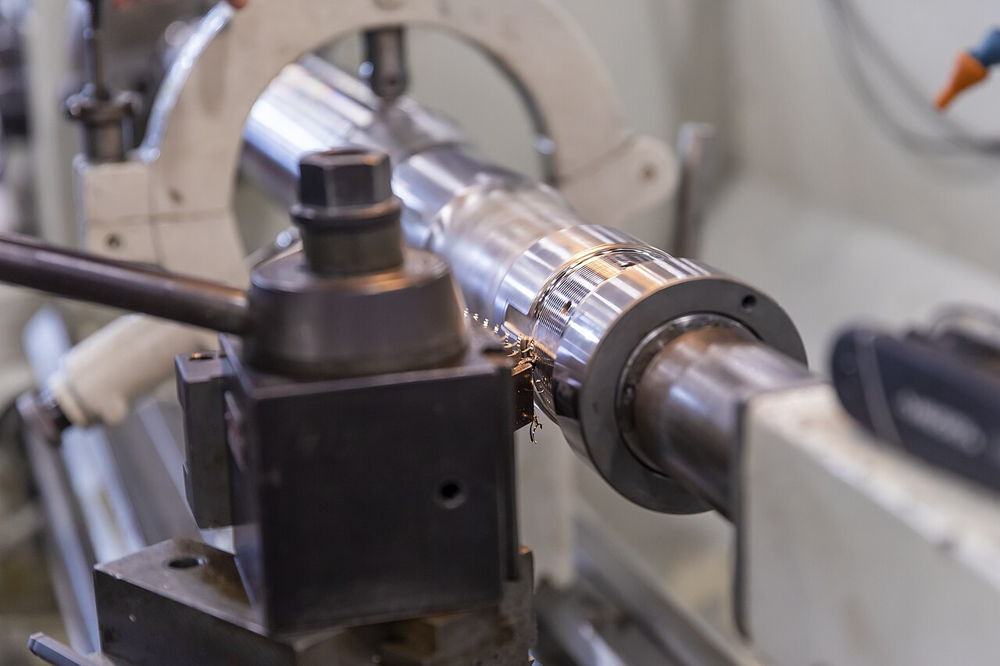

- Metal Parts and CNC Machined Components: China’s metal fabrication and machining shops produce everything from sheet metal enclosures to turned and milled parts. CNC components with tight tolerances are sourced for industries like aerospace, automotive, and electronics assembly.

- Castings and Forgings: With extensive foundry capacity, China supplies cast metal parts (iron, steel, aluminum castings) and forged parts. These include engine blocks, pump housings, brackets, and gear blanks, often made per ASTM/ASME material standards.

- Electrical Enclosures and Assemblies: Electrical control boxes, enclosures, cable assemblies, and other electrical hardware are commonly imported from China. Suppliers offer enclosures with standard ratings (e.g. NEMA, IP67) at lower costs, as well as custom metal or plastic housings for industrial equipment.

China’s sheer production volume and supplier base depth in these categories means importers can usually find multiple vendors to quote any given part. However, the abundance of options also means due diligence is needed to identify capable, reliable manufacturers for your specific requirements.

Key Risks in Industrial Sourcing from China

While cost savings and variety are big advantages, sourcing industrial parts from China comes with key risks that buyers must manage proactively. The most common challenges involve quality consistency, specifications compliance, and communication gaps between U.S. buyers and Chinese factories:

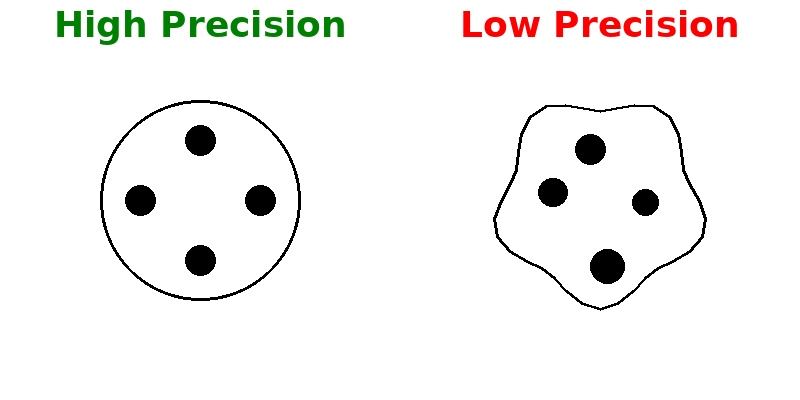

Tight Tolerances & Precision

Achieving precise tolerances can be a challenge if not clearly defined and enforced. A part that is off by even 0.1 mm in critical dimensions might not fit or function as intended. Some suppliers may ask to relax tight tolerance requirements if they lack the capability to consistently meet them. It’s crucial to specify tolerances in drawings/contracts and confirm the factory has the technology (e.g. CNC equipment, precision jigs) to hold those tolerances during mass production. Overlooking this can result in parts that are out of spec and require costly rework or scrapping.

Material Inconsistency

Using inferior or incorrect materials is a known risk. A supplier might substitute a cheaper grade of metal or plastic to cut costs, leading to parts that wear out faster or fail under stress. For example, a valve body specified in stainless steel might arrive in a lower-grade alloy if the supplier isn’t strictly monitored. Such material inconsistency can undermine compliance (e.g. not meeting ASTM standards) and performance. Always verify material grades via certifications (mill test reports) or independent lab testing to ensure you’re getting exactly what you ordered.

Compliance Gaps

Industrial components often need to meet specific certification standards (safety, environmental, etc.). A key risk is that a factory, deliberately or not, ships products that do not fully comply with required standards or regulations. This could include missing certifications (e.g. no UL listing on an electrical part), improper labeling, or failure to meet country-specific requirements. Compliance gaps can lead to customs issues, liability problems, or field failures. Importers should clearly communicate all compliance criteria and test/audit products for adherence (more on this in the next section).

Lack of Thorough Performance Testing

Without robust quality assurance and testing, parts might pass visual inspection but fail in real-world use. For instance, a batch of motors might work initially but overheat after hours of operation due to inadequate testing. Key performance tests – such as pressure testing valves, torque testing fasteners, or load testing a motor – should be conducted to verify that each lot meets the functional requirements. Relying on a supplier’s word without independent testing or witnessed factory tests can be risky.

Quality Fade over Time

Perhaps the most insidious risk is quality fade, where a supplier initially delivers good quality to win your business, then gradually cuts corners on subsequent orders. You might receive an excellent first shipment, but later batches show subtle issues – slightly softer metal, more variability in dimensions, cosmetic defects, etc. This “slow-motion” decline in quality can be hard to detect until major problems surface. It often stems from cost-cutting on materials or processes once the supplier assumes the relationship is secure. To combat this, continuous monitoring and periodic re-inspection of orders (even after a stable relationship is established) is critical. Make it clear that you will inspect each batch and enforce the agreed standards throughout the partnership.

Communication and Cultural Differences

Lastly, language barriers and different business norms can pose risks. Misunderstandings in technical specs or quality expectations can occur. Chinese manufacturers may not always proactively voice concerns; for example, instead of saying a design is challenging, they might quietly attempt it and fall short. It’s important to maintain clear, frequent communication, possibly in Chinese language via a translator or local agent, and to cultivate a relationship where the supplier feels comfortable raising issues. Providing detailed documentation (in Chinese if possible) and confirming understanding at each step can mitigate these risks.

By anticipating these challenges, you can implement safeguards (discussed below) to significantly reduce your risk exposure. Rigorous supplier selection, clear contracts, and ongoing oversight go a long way to ensure your China to US industrial sourcing pipeline delivers consistent results.

Certification Standards and Testing Requirements

Ensuring compliance with international standards is a non-negotiable aspect of industrial sourcing. Many industrial products must meet safety, performance, and environmental regulations in the U.S. and other target markets. When sourcing from China, buyers should verify that both the manufacturer and the products have the necessary certifications and have passed relevant tests:

Factory Certifications (ISO)

A quality-focused supplier should be ISO 9001 certified, indicating they maintain a robust quality management system. ISO 9001 certification gives confidence that the factory has documented processes for production and inspection, and is audited regularly. Other ISO standards might apply too (ISO 14001 for environmental management, ISO 45001 for safety, etc.), depending on your priorities. Ask for copies of the supplier’s ISO certificates and check they are current and issued by a reputable certification body.

Product Safety Standards (CE, UL, etc.)

Determine which safety marks or standards your product must comply with. For example, electrical components may require UL certification (for the U.S. market) or CE marking (for Europe) to indicate they meet safety directives. If you’re importing something like an industrial fan or a power tool, verify if it needs UL listing or FCC compliance for electromagnetic interference. Similarly, machinery might need to meet ANSI/ASME standards or carry a CE mark if it will be re-exported to Europe. Ensure the Chinese supplier is familiar with these and can produce the necessary test reports or certificates. It’s wise to request copies of any existing certifications (UL files, CE declaration of conformity, etc.) early in supplier evaluation.

Material and Environmental Compliance (RoHS, REACH)

For products with electronic or chemical components, check RoHS compliance (Restriction of Hazardous Substances) if required – this ensures no prohibited substances like lead or mercury beyond allowed limits. China does produce RoHS-compliant components, but you must specify this requirement and often test randomly to verify. If the product involves chemicals (coatings, plastics), REACH compliance (for EU chemical safety) could be relevant. Always communicate these needs clearly so the supplier can source compliant materials.

Industry-Specific Standards

Different products have specialized standards – e.g., ASTM or DIN standards for material properties of metals, ASME codes for pressure-containing parts like valves or boilers, API standards for oilfield equipment, FDA compliance for food-grade machinery, etc. Identify all that apply. A reliable supplier will usually advertise which standards they can meet or have experience with. During vetting, ask if they’ve made products to those standards and possibly get references or documentation of prior compliance.

Third-Party Laboratory Testing

Do not solely rely on factory-provided data for critical compliance. It’s often prudent to send samples to an independent certified lab for testing. For example, have a lab verify the metal alloy composition, hardness, or tensile strength (per ASTM specs). For electrical items, consider a pre-shipment lab test for safety (dielectric withstand, grounding continuity, etc.). This extra step may add cost, but it is far cheaper than a recall or liability lawsuit if a non-compliant product reaches customers.

Chinese Regulatory Compliance (CCC)

Note that China itself has a compulsory certification (CCC) for certain product categories (mostly electronics, appliances, vehicles). If you plan to also sell in China or just as an indicator of quality, check if the product needs and has a CCC mark. While this is not required for U.S. import, a Chinese manufacturer who has passed CCC testing for their domestic market is likely familiar with rigorous compliance processes.

In summary, make a compliance checklist for your product and verify each point with the supplier. This should include factory-level certifications and product-specific tests. Incorporate these requirements into your purchase agreement. Clearly state that failing to meet standards is grounds for rejection of goods. By front-loading these discussions, you filter out factories that are not up to par and avoid unpleasant surprises after production. Remember, ensuring compliance is ultimately the importer’s responsibility, so diligence in this phase is critical.

How to Vet and Audit Industrial Suppliers

Identifying a capable supplier is perhaps the most important factor in a successful sourcing project. With thousands of factories to choose from, a structured supplier vetting and audit process will help you select a partner that can truly deliver. Here are best practices for vetting and auditing Chinese industrial suppliers:

Background Research

Start by gathering information on the supplier’s reputation and track record. Search for the company name in importer forums or supplier directories. Check if they are a trading company or a manufacturer (many trading companies pose as factories). Verify how long they’ve been in business and what their main export markets are. A quick company registration lookup (e.g. on the National Enterprise Credit Information Publicity System in China) can confirm the factory’s legitimacy and registered capital. Rule out any supplier with a sketchy background or inconsistent information.

Request Documentation

A serious supplier will readily provide documentation for review. Ask for copies of their business license, export license, and any industry-specific licenses (for example, a pressure vessel manufacturer should have specific permits). Also request quality system certifications like ISO 9001, as well as product certifications relevant to what you’re buying (CE, UL, etc.). If they claim experience with U.S. clients, ask for references or examples. Legitimate factories often have brochures or a catalog of past projects – examine those to see if they have made products similar to yours.

Evaluate Capabilities

Ensure the supplier’s capabilities match your requirements. This means looking at their facilities, equipment, and workforce skills:

- Factory Size & Equipment: How large is the factory and how modern is the machinery? For CNC parts, do they have CNC lathes/mills of the right precision? For castings, do they have advanced furnaces and quality foundry controls? A factory audit (in-person or via a third-party) can verify if they really have the machines listed on their website. A comprehensive factory audit is one of the best ways to mitigate risk when importing from China, providing transparency into the supplier’s operations and verifying they have the right certifications, facilities, and skilled workers to fulfill your order.

- Technical Expertise: Gauge the engineering and English communication level of their staff. Can they discuss tolerances, materials, and standards knowledgeably? If they have an engineering team that can review your drawings and offer DFM (Design for Manufacturability) input, that’s a positive sign.

- Production Capacity: Determine if the factory can meet your volume and lead time needs. Ask about their current production line utilization and maximum capacity. A factory might be excellent but too small to handle a large order on your timeline.

Audit the Factory (On-site or Virtual)

Performing a factory audit (either by visiting the site or hiring a third-party inspector) is highly recommended before finalizing any big contract. During an audit, review areas such as:

- Quality Management Processes: Check if they have incoming material inspection, in-process QC checkpoints, and final inspection records. A good supplier will show you inspection tools (calipers, CMM machines, gauges) and example QC reports. Confirm they calibrate their equipment regularly.

- Workshop Conditions: Observe the organization and cleanliness of the shop floor. A well-organized factory with clear work instructions and labeled materials is likely to be more reliable. Also, look at how they handle parts – are there proper racks or packaging to prevent damage/mix-ups?

- Worker Skills and Morale: Sometimes just observing workers can be telling. Are workers skilled in what they do (welding, machining, assembly)? Do they appear overworked or fairly content? High turnover or unhappy workers can indicate management issues that might affect your order.

- Storage and Logistics: Check the warehouse for how raw materials and finished goods are stored. Are there signs of rust, moisture, or poor handling? Also inquire about how they pack products for shipping (especially export packaging for long sea freight).

Sample Production & Testing

Before full production, have the supplier make pre-production samples or prototypes. Inspect these samples carefully or even have them sent to you for approval. This is a critical test of whether the factory understood your requirements and can deliver. It’s much cheaper to catch issues at the sample stage than after 10,000 units are made. Require that the final production will not deviate from the approved sample without written consent.

Verify References and Past Clients

Don’t hesitate to ask for references from other foreign customers. Even if they can’t share confidential details, a reputable supplier might connect you with a long-term client (with permission) to speak privately. Alternatively, look at filed compliance reports or audits – some suppliers will have had audits by companies like SGS, Intertek, or Bureau Veritas. Reviewing an audit summary (if available) can validate things like their quality control, capacity, and any past issues. Any reputable exporter will have compliance assessment reports; reviewing these can reveal red flags or strengths.

Before finalizing a supplier, verify their business licenses and certifications, confirm they have a quality management system (e.g. ISO 9001), ensure they can provide compliant test reports for your product (CE, UL, RoHS as applicable), review their production capabilities in person or via a detailed audit, and approve pre-production samples. Taking these steps will significantly reduce the risks of partnering with a new overseas vendor.

Investing time in thorough vetting and audits may seem tedious, but it pays off by selecting the right partner. It’s far better to spend a few weeks qualifying a supplier than to rush and face months of quality headaches later. Remember the adage: trust, but verify – apply it rigorously in supplier selection. A well-vetted supplier will save you countless troubles down the line and set the foundation for a smooth sourcing program.

Quality Control and Shipment Inspections

Even with a great supplier onboard, you cannot skip implementing strong quality control (QC) measures. Quality control in China should be viewed as a continuous process – from the moment production starts until final packaging – not a one-time event. Here are essential tips and best practices for effective QC and ensuring the parts you receive meet your standards:

Define Detailed Specifications Upfront

Quality control begins with your specifications. Provide the supplier with a very clear, written spec sheet covering all requirements: dimensions and tolerances, material grades, surface finish, coatings, labeling, packaging, and performance criteria. The more unambiguous your specs, the less room for error. Include drawings with tolerances on every critical dimension. If certain tests (e.g. pressure test to 100 psi, or hardness HRC requirement) are needed, list them. Both parties should agree to these specs in the contract. Clear requirements for materials, tolerances, labeling, and packaging should be defined at the start of production. This forms the baseline for all inspections.

Use Quality Control Checklists

For each product, develop a QC checklist that inspectors will follow. This checklist translates your specs into an actionable inspection plan. It might include visual checkpoints (“No burrs or sharp edges; paint color matches Pantone XYZ”), functional tests (“valve opens under 50 N of force; motor runs without abnormal noise”), and measurements (“all holes ±0.1 mm of drawing”). A good practice is to share this checklist with the supplier too, so they know exactly how the goods will be judged. This transparency often motivates the factory to self-check more carefully before presenting goods for inspection.

In-Process Inspections (DUPRO)

Don’t wait until everything is finished to inspect. For complex or high-value orders, arrange for during production inspections (often called DUPRO). This could be done when, say, 20-30% of the order is completed. An in-process check can catch issues early – for example, if a machine setting is off or a wrong component is being used, you can halt production and correct it before it yields thousands of defects. It also shows the supplier that you are serious about quality at every stage.

Independent Third-Party Inspections

While you may trust your supplier, having independent inspections is highly recommended, especially for first orders or periodically. Firms like SGS, Bureau Veritas, AsiaInspection (QIMA), or local Chinese QC agencies can send an inspector to the factory to perform checks on your behalf. These inspectors use the checklist you provide and issue a detailed report with pictures. Using a third party reduces bias – you get an objective view of the goods. Many experienced importers leverage third-party QC for pre-shipment inspections routinely.

Pre-Shipment Inspection (PSI)

The final checkpoint is the pre-shipment inspection, done when production is 100% complete (or at least >80% so samples are representative) and goods are packed for export. During a PSI, inspectors will typically:

- Verify Quantity: ensuring the ordered number of units is present and correctly packed.

- Check Workmanship & Appearance: visually inspect for defects, scratches, incorrect assembly, etc., against acceptable quality levels.

- Perform Functional Tests: test a sample of products to ensure they work as intended (e.g. a random motor from the batch is run to check RPM and noise; a random valve is pressure-tested).

- Compliance Checks: verify that all labels, certifications, and markings are correctly applied (UL logo, CE mark, lot numbers, etc.) and that any required documents (manuals, safety info) are included.

- Packaging Inspection: confirm packaging is correct – proper barcodes, shipping marks, and that the packaging protects the product adequately for transit.

The inspection is usually done based on a statistical sampling plan. The industry standard is ANSI/ASQ Z1.4 (ISO 2859-1) AQL sampling, which defines how many samples to inspect per batch size and what defect rates are allowable. For example, you might choose an AQL level such that 0% critical defects, 2.5% major, 4.0% minor are accepted. If the inspection finds more than these thresholds, you can reject the batch or require rework. It’s important to clearly state in your purchase agreement that the order is subject to passing a pre-shipment inspection per these criteria.

On-site Testing Equipment

During audits or inspections, check that the supplier has appropriate testing equipment for your product. For instance, if you’re sourcing electrical parts, do they have a high-voltage tester (HIPOT)? If sourcing metal parts, do they have hardness testers, gauges, or even a spectrometer for material analysis? A factory that possesses and uses such equipment regularly is likely to catch quality issues themselves. If they lack basic testing tools, that’s a red flag – you’ll be relying solely on outside inspections.

Continuous Improvement and Feedback

Use each inspection not just to accept/reject products but as feedback to the supplier. For example, if the inspection reports recurring minor issues (say, 5% of parts had minor scratches), discuss this with the supplier and ask for root cause analysis and corrective action. Perhaps they need better padding in the packaging or improved worker training. Good suppliers will appreciate this feedback and improve over time. This process of communicating QC results helps build a stronger partnership and drives continuous improvement in quality.

Final Checks on Arrival

Even after all the precautions, do a quick incoming quality check when the shipment arrives at your U.S. facility (especially for the first few orders with a new supplier). This can be a simple sampling – to verify nothing shifted during shipping and that no mix-up occurred. It’s rare, but sometimes freight handling can damage goods or incorrect items get packed by mistake. An arrival check is your last safety net.

In summary, robust quality control is not about mistrust – it’s about ensuring both you and the supplier are on the same page regarding what’s acceptable. Many Chinese suppliers are accustomed to strict QC processes and will not be offended by inspection requirements; rather, they often expect it. By scheduling inspections and communicating results, you protect your business and give the supplier clear targets to meet. This reduces the risk of costly surprises, like a container full of unusable parts, and strengthens your supply chain reliability in the long run.

Conclusion: Partnering for Success in China Sourcing

Sourcing industrial components from China offers immense benefits – cost savings, production flexibility, and access to manufacturing innovations – but it also requires savvy management of risks and relationships. By understanding the popular product categories and their dynamics, recognizing and mitigating key risks (from tolerance issues to compliance), enforcing international standards, and rigorously vetting suppliers and monitoring quality, you can build a robust industrial supply chain from China to the U.S. that sustains your production needs.

Remember that successful sourcing is not a one-time transaction but a process of continuous improvement and partnership. Establish clear expectations with your supplier, maintain open communication, and remain hands-on through audits and inspections. When issues arise, address them collaboratively – the goal is to build a long-term relationship where the supplier views your business as a partner, not just a purchase order.

Finally, consider leveraging professional sourcing assistance if navigating this landscape feels overwhelming. Teams like China Direct Source specialize in end-to-end vetted industrial sourcing – from supplier identification and factory audits to quality inspections and logistics. With on-the-ground expertise, they can help avoid pitfalls and drive continuous quality improvements for your projects. If you are looking to simplify your China sourcing while ensuring total peace of mind on quality and compliance, contact China Direct Source for support. With the right approach and partners, importing industrial parts from China can become a smooth, strategically advantageous aspect of your manufacturing operations.