The U.S. electronics market continues to expand, and savvy importers are eyeing China’s latest products to meet demand. By 2025, China’s consumer electronics market is projected to exceed $212 billion, driven by smartphones, smart home gadgets, and eco-friendly devices. Imports from China dominate categories like wireless earbuds, smartwatches, Bluetooth speakers, LED lights and phone accessories. Smart-home items (voice-controlled bulbs, cameras, robot vacuums, etc.), wearable tech, and innovative personal gadgets are especially hot. We’ll explore the top categories (both low-cost/high-volume and high-margin items), U.S. import regulations (FCC, UL, batteries), and sourcing tips (OEM vs ODM, Alibaba vs agents) for 2026.

Smart Home & IoT Devices

Smart-home electronics – from Wi-Fi light bulbs and smart locks to robot vacuum cleaners – are surging in popularity. China offers a huge range of IoT home devices at low cost, and U.S. consumers are snapping them up. For example, robotic vacuum cleaners with self-emptying bins are seeing explosive demand, with top models pulling in over $2 million/month in sales. Similarly, smart bulbs, plugs, security cameras, thermostats and appliances (smart fridges, air purifiers, etc.) are among China’s top-selling exports. Analysts note that smart home gadgets like vacuum robots and air purifiers “dominate e-commerce platforms,” especially those compatible with Alexa/Google Home. This aligns with the U.S. smart-home market boom: it grew to about $28.3 billion in 2024 and is forecast to reach nearly $100 billion by 2032.

U.S. importers should look for innovative home IoT items that balance price with quality. Low-cost, high-volume goods like LED smart bulbs or Wi-Fi smart plugs can be ordered in bulk (often under $5–$10 per unit) and resold for strong margins. At the same time, higher-margin premium home gadgets – such as advanced robot vacuums, smart security systems, or touchscreen thermostats – can command higher prices. All must be FCC-certified (since they emit RF signals) and often need UL or ETL safety approvals before retail sale.

Wearables & Health Gadgets

Wearable tech remains a dynamic import segment. Wireless earbuds and fitness smartwatches are perennial best-sellers (the Amzscout list highlights earbuds and smartwatches among the most profitable Chinese electronics). Indeed, post-pandemic health trends are driving fitness trackers, smartwatches and health devices to new heights. For example, fitness bands, blood-oxygen monitors, and even personal massage guns are topping charts – “health and wellness tech” like fitness trackers and smartwatches are thriving. Tech market research confirms this: smartwatches still “drive wrist-worn wearable growth in 2025,” and advanced health sensors (ECG, sleep-tracking, SpO₂) are becoming ubiquitous in new models. Cutting-edge wearables like smart glasses and rings are also emerging. TechInsights notes that “smartglasses and smart rings are gaining traction with lightweight designs and innovative health-tracking capabilities”. Even VR/AR headsets and mixed-reality devices have strong interest, though U.S. tariffs on Chinese imports (now 245% on many AR/VR goods) mean importers must carefully manage costs in that niche.

In the accessories sub-category, consider the ecosystem around wearables: high-capacity power banks, wireless charging stations, protective cases, and head straps. Many of these accessories are cheap to source and high-volume sellers. (For example, Amzscout flags “phone cases and chargers” as top China imports.) Overall, wearable-related imports offer a mix of low-cost high-volume items (wireless earbuds, band straps, chargers) and higher-end innovative devices (fitness smartwatches, VR headsets, smart glasses).

Personal Gadgets & Trending Tech

This catch-all category covers cool gadgets and novelties that spark consumer interest. It includes things like drones, portable projectors, electric scooters, and eco-gadgets. Chinese suppliers excel at cost-effective gadgets such as mini drones, Bluetooth speakers, smartphone projectors, smart flashlights and IoT-embeddable devices. One of 2025’s biggest sub-trends is eco-friendly tech: solar-powered chargers and rechargeable lanterns. In fact, market analysis highlights solar-powered USB chargers as a “significant opportunity” in 2025. Portable solar panels (from foldable panels to USB solar power banks) are in high demand, riding the sustainability wave.

Other trending imports include advanced gaming peripherals (VR controllers, racing wheels), 3D printers, and smart wearables (like pocket translators or pet trackers). Low-cost everyday gadgets – mobile phone accessories, LED bicycle lights, smartwatch bands – should not be overlooked either. For example, portable battery packs (including solar chargers) and USB charging hubs are perennial import hits. Given the eco trend, solar chargers are especially noteworthy: Chinese-made foldable panels and solar power banks sell cheaply but can retail at good margins in outdoor/electronics stores.

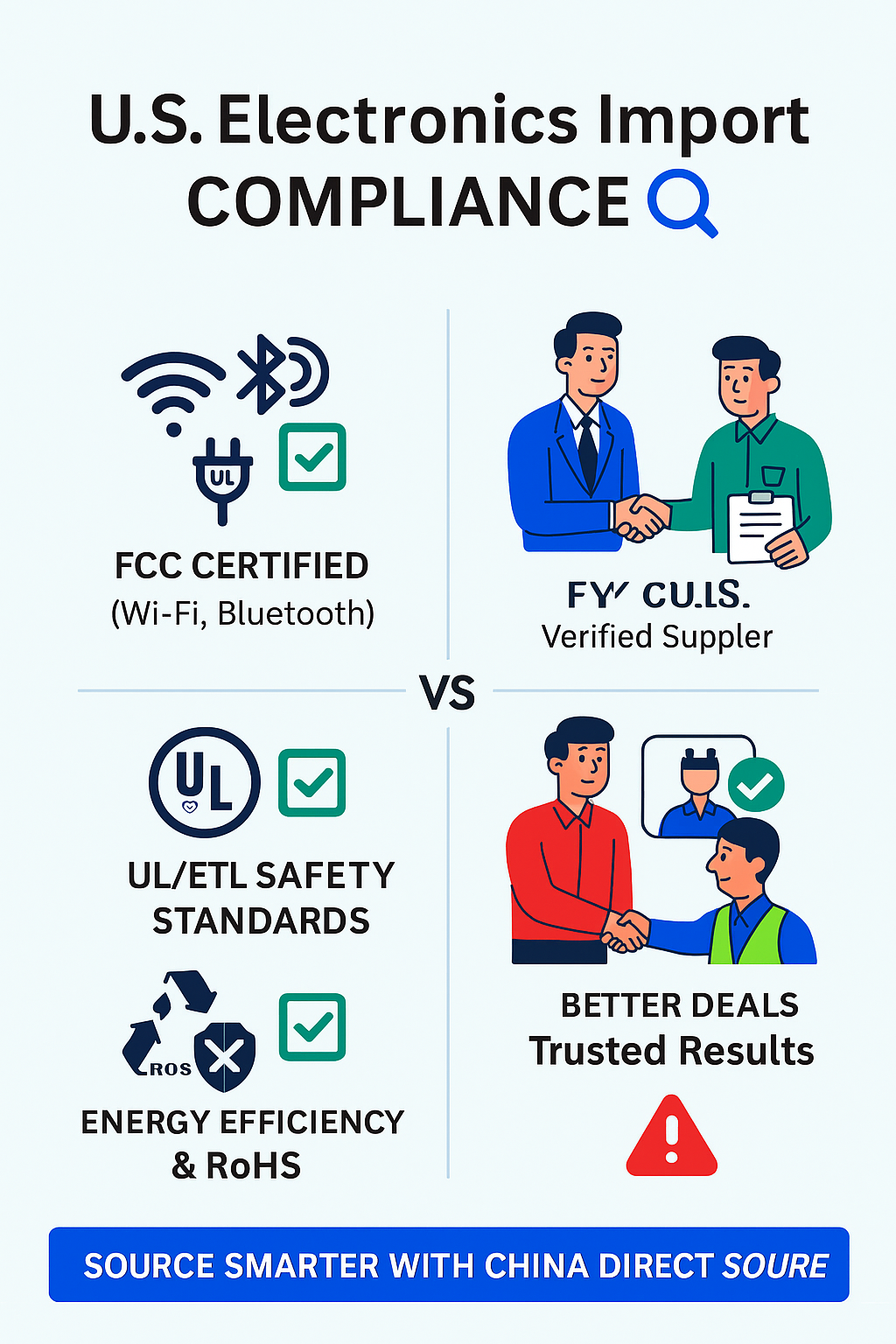

U.S. Import Compliance & Certifications

Importers must navigate several U.S. regulatory hurdles. Crucially, any device emitting radio frequencies must have FCC certification or authorization. This means wireless gadgets (Wi-Fi devices, Bluetooth speakers, routers, etc.) must be tested and carry a visible FCC ID label upon import. Failure to comply can trigger customs seizures. In practice, you’ll need either an FCC Grantee Authorization or Supplier’s Declaration of Conformity for each wireless product. Even non-RF electronics often require safety certifications: while UL listing is voluntary, it’s widely expected by U.S. retailers and consumers for electronics like appliances, chargers, and power tools. Obtaining UL or ETL marks (or their equivalents) can speed market acceptance.

Other key considerations include:

- Battery Regulations: If products contain lithium-ion batteries (common in phones, toys, power banks, scooters, etc.), they must meet strict safety and shipping rules. Lithium batteries require special testing (UL 2271/UL 2054) and proper hazard labels on packages. Airlines and shippers impose weight limits and restrictions, so plan for compliant packing.

- Hazardous Substances (RoHS): U.S. electronics should restrict toxic materials (lead, mercury, cadmium) similarly to EU RoHS standards. While the U.S. has no single federal RoHS law, adherence is often required by retailers or by state rules (e.g. California).

- Energy/Efficiency Labels: Products like appliances or lamps may need EnergyStar or DOE compliance labels (for efficiency ratings). Even if not mandatory, these certifications boost consumer trust.

- Tariffs & Duties: Carefully classify goods under the Harmonized Tariff Schedule (HTS) to determine duties. Be aware of any Section 301 tariffs on Chinese electronics (many categories face extra duties). For example, recent US tariffs on Chinese imports (up to 25%) have significantly raised costs of items like VR headsets. Factor these into your landed-cost calculations.

Adhering to these rules pays off. Importers should budget for certification/testing fees (FCC lab tests, UL inspections), and potentially work with a compliance consultant. Proper documentation (FCC IDs, test reports, etc.) should accompany each shipment to clear U.S. Customs smoothly.

Sourcing Strategies: OEM/ODM and Supplier Choices

Deciding how to source products is as important as what to source. First, consider OEM vs. ODM manufacturing. An OEM (Original Equipment Manufacturer) produces goods strictly to your custom designs. This yields a unique product for your brand (often with exclusivity clauses), but requires you to invest in R&D and product development. In contrast, an ODM (Original Design Manufacturer) offers ready-made product designs that you can rebrand. ODMs dramatically cut development time – their engineers have already built a base model you can tweak – but you’ll compete with others selling similar items. In short: go OEM if you have a distinctive idea and budget for mold/tooling; choose ODM if you need to launch quickly on proven designs with lower upfront cos.

Next, pick your sourcing channels. For many importers, B2B marketplaces are the starting point. Platforms like Alibaba.com and 1688.com host thousands of Chinese suppliers of electronics. They let you browse catalogs, compare prices, and use escrow services to protect payments. Alibaba’s Trade Assurance program, for example, helps ensure suppliers meet quality and delivery terms. These sites are convenient for getting small test orders or bulk deals (and many manufacturers on Alibaba accept modest MOQs).

However, online platforms aren’t the only option. Sourcing agents – third-party China-based representatives – can manage complex steps (supplier verification, quality inspections, freight and customs paperwork). Agents charge a fee or commission, but they’re invaluable if you lack local contacts or language skills. They can vet factories, conduct factory audits, and oversee production, ensuring your specs are met. In practice, agents reduce headaches, especially for sophisticated electronics requiring tight quality control.

Finally, don’t overlook trade fairs and direct factory visits. Big expos like the Canton Fair or Global Sources Exhibition let you meet manufacturers face-to-face. You can see live demos, negotiate terms, and build trust more easily than online. Attending these fairs has enabled many importers to find reliable electronics suppliers that they wouldn’t have found on Alibaba.

Compliance Checklist

- FCC (Wireless) – Required for all radiofrequency devices (Wi-Fi, Bluetooth, cellular). Must test to FCC Part 15 rules and label with FCC ID.

- UL/ETL (Safety) – Not legally mandatory, but expected by many U.S. retailers for appliances, chargers, batteries, etc.

- Battery Safety – Lithium batteries need UL certification and special shipping labels. Check IATA rules for air shipment.

- RoHS & Environmental – Restrict heavy metals and follow e-waste recycling laws. Eco-friendly electronics (e.g. solar chargers) should highlight ISO 14001 or EnergyStar if available.

- Tariffs & HTS – Classify products under the HTS and include landed costs for duties. Watch for additional tariffs on Chinese imports.

Choosing Suppliers: Key Tips

- OEM vs ODM: Decide up front. OEM = you own the design (higher R&D cost, exclusive); ODM = you adopt a design (faster, cheaper, but more competition).

- Alibaba/Online Sourcing: Good for discovery. Vet suppliers via on-site visits if possible. Use Trade Assurance and ask for factory audits.

- 1688.com & Others: For experienced importers, 1688.com (the Chinese domestic B2B site) often offers lower prices, though it requires payment with Chinese RMB accounts. Global Sources and Made-in-China.com are alternatives.

- Sourcing Agents: Consider hiring an agent if you’re new or importing high-value electronics. A knowledgeable agent can negotiate, inspect goods, and handle logistics.

- Trade Fairs: Meet suppliers in person. A face-to-face meeting at Canton Fair or specialized electronics expos can seal deals and help assess production capabilities.

Conclusion

Importing electronics from China in 2026 remains a lucrative strategy, but success requires both product smarts and compliance savvy. Prioritize products in booming categories – smart home gadgets, wearable health tech, personal IoT devices, and eco-friendly electronics – that match current U.S. consumer trends. Balance low-cost, high-volume staples (LED bulbs, earbuds, power banks) with high-margin novelties (robot vacuums, smartwatches, AR/VR headsets). Always verify that suppliers understand U.S. requirements (FCC, UL, battery standards) and weigh the pros/cons of OEM vs ODM partnerships. Finally, choose your sourcing channels wisely – whether it’s Alibaba and 1688 for convenience or agents and fairs for deeper support. By staying informed and proactive, importers can ride the next wave of electronics trends with confidence.